If you’ve considered adding electric vehicle (EV) charging stations to your property or upgrading your fleet to EVs, the price tag may have stopped you from finalizing the purchase. But did you know that there are local and federal electric vehicle business tax credits, rebates and incentives for installing electric vehicle charging stations?

Why do electric vehicle business tax credits for chargers exist?

Everyone wants the newest technology, but the latest and greatest can come with a heavy price tag, whether you wanted to outfit your staff with laptops in the 1990s or are looking to purchase the top-tier iPhone today. When the bottom line is an organization’s goal, spending money on new technology may not seem like a good use of funds.

However, technology like electric vehicles requires widespread adoption for prices to lower to more affordable levels and — at least in the case of EVs — that enough infrastructure can be available. While each state or province has its own EV adaptation strategy, individual buy-in by companies that can provide public charging is necessary to be able to meet the needs of a growing EV population.

To aid in this adoption of EVs, states, provinces and federal entities provide tax credits to businesses for installing electric vehicle charging stations.

How much can I get in business tax credits for electric vehicle charging?

The amount available for an electric vehicle business tax credit depends on how much a local and federal government wants to aid in the adoption of the technology, so it differs depending on if you’re in the U.S. or Canada, and then by state or province. However, state or province business EV charger tax credits, rebates and incentives can be stacked on top of federal incentives.

Because tax credits and incentives differ widely depending on where you live and other specifics such as the date you purchased and installed the EV chargers, it’s important to research the latest available credits and incentives in your area.

In the United States, a federal electric vehicle charging tax credit for businesses can be claimed by filing Form 8911, the Alternative Fuel Vehicle Refueling Property Credit. Up to 30% or $30,000 — whichever is lesser — of the cost for the EV charger and commercial installation can be claimed through the 2021 tax year. Use the January 2022 revision of Form 8911 for tax years beginning in 2021. Unless renewed, the federal tax credit for commercial purposes expires with the 2022 tax year.

What about local utilities electric vehicle charger tax credit for businesses?

Unlike federal, state or provincial tax credits, your local utility may provide incentives in the form of rebates or lower electricity bills. If your local utility offers an incentive program, you’ll be asked to connect your iEVSE or iEVSE Plus unit to their grid with allowances for charging during off-peak hours, or increased savings if you choose to charge during off-peak hours. Off-peak hours are typically 10 p.m. to 8 a.m. Monday through Friday and weekends.

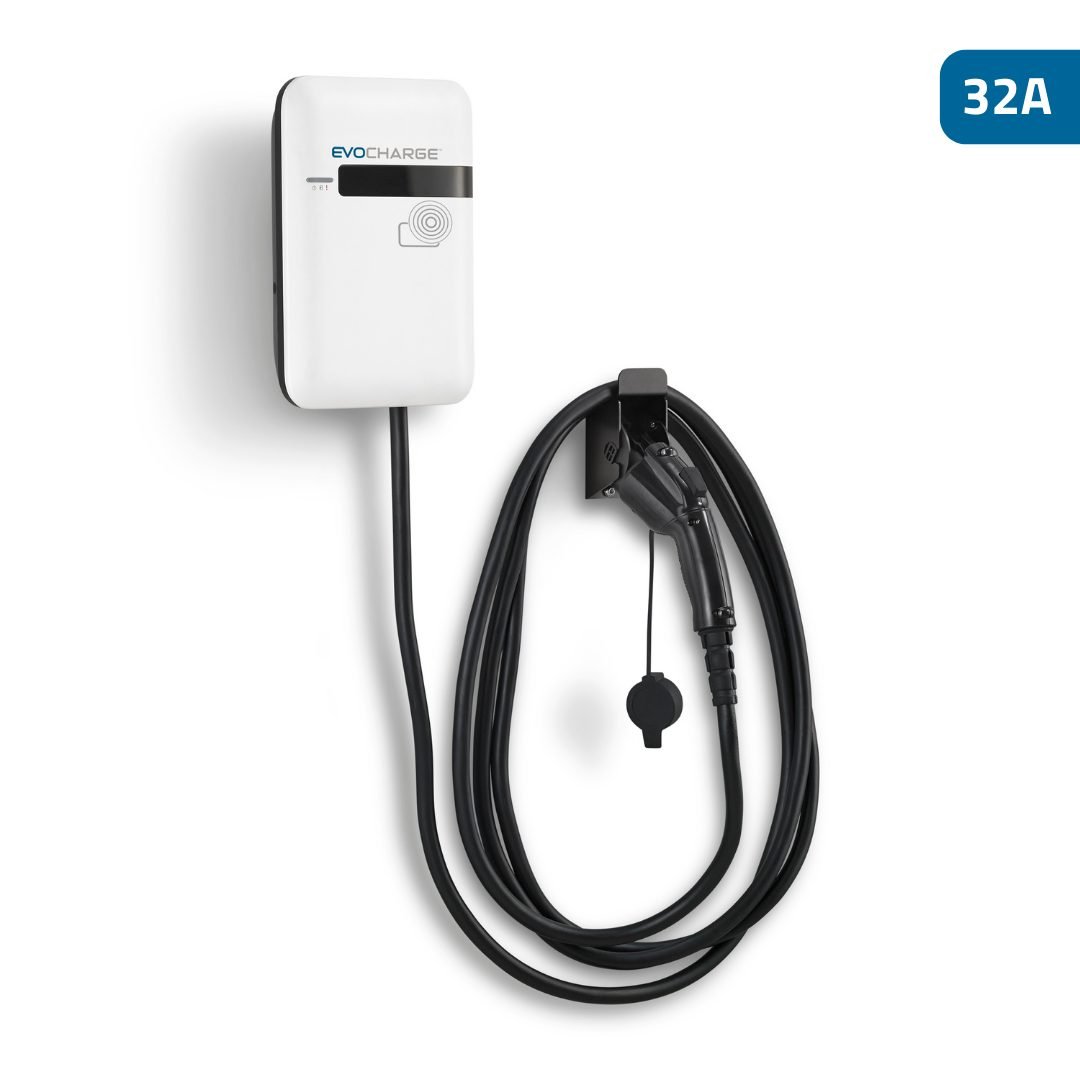

Want to learn more? Find additional information on federal electric vehicle charger tax credits, rebates and incentives for businesses. Or if you’re ready to find the perfect EVSE charging station for your property, shop our available units.